Professionals of Arcostec Group are constantly working to improve service and expand the scope of the company’s activities. In the article below we have tried to cover the different municipalities of the Costa Blanca and Costa Cálida in order to offer our clients the most detailed information on municipal relocation taxes in each specific area.

In addition to the tax amount (it can be fixed or variable , depending on the useful or total area of the housing), we provide official declaration forms for filling out, as well as a list of documents required in each locality

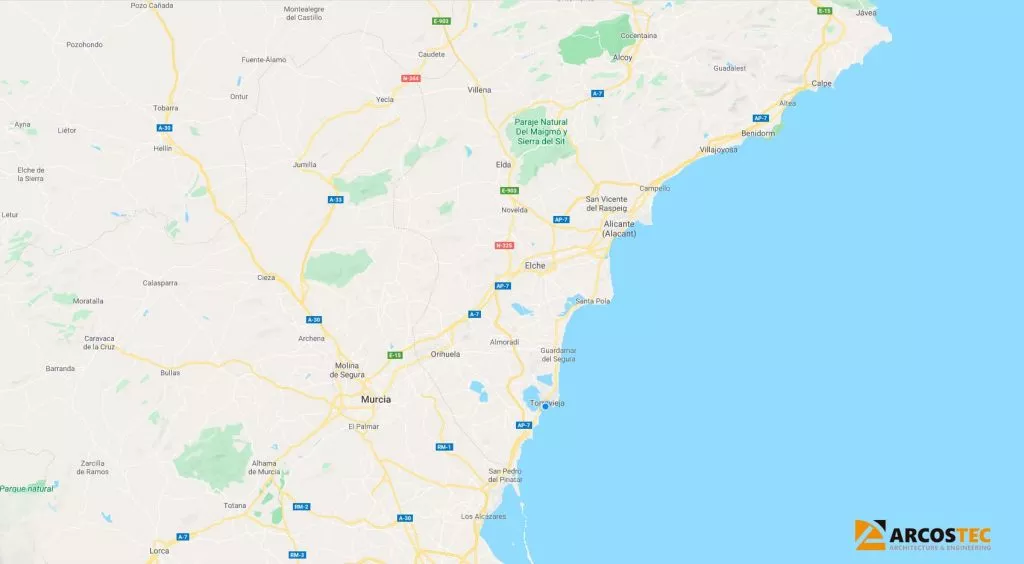

COSTA BLANCA AND COSTA CALIDA: MUNICIPALITIES IN WHICH ARCOSTEC GROUP OPERATES

Arcostek specialists constantly work throughout the province of Alicante and Murcia. We work with all municipalities, but we are more focused on the coastal part. We work on the Costa Blanca and Costa Calida (Murcia). Below we provide a list of municipalities with which we work on an ongoing basis. If for some reason your city is not on this list, contact us, and our specialists will inform you without compromise.

Arcostek specialists constantly work throughout the province of Alicante and Murcia. We work with all municipalities, but we are more focused on the coastal part. We work on the Costa Blanca and Costa Calida (Murcia). Below we provide a list of municipalities with which we work on an ongoing basis. If for some reason your city is not on this list, contact us, and our specialists will inform you without compromise.

Municipal license for reoccupation

Find your locality and find out what documents are needed to obtain a license for re-occupation.

List of localities in which Arcostec Group operates

1. Alicante

Required documents:

- Declaration of liability

- Power of Attorney

- Owner's NIE

- NIE of the trustee

- Deed of sale or updated extract from the real estate register (Nota Simple)

- IBI Council Tax

- Technical certificate issued by the architect

- Architect's Declaration of Responsibility

- Extract from the cadastre

- Color photograph of the building facade

- Council tax payment

- If available, license to the previous owner

Council tax amount for reoccupancy:

- In residential buildings: € 79.57

- In unused commercial or residential buildings: € 111.39

- In residential buildings that do not have a license for initial occupancy from the developer: € 190.96

2. Althea

Required documents:

- Declaration of liability

- Power of Attorney

- Owner’s NIE + passport

- NIE of the trustee

- Deed of sale or updated extract from the real estate register (Nota Simple)

- IBI Council Tax

- Technical certificate issued by the architect

- Architect's Declaration of Responsibility

- Invoices for water and electricity

- Payment of municipal tax

- If available, license to the previous owner

Council tax amount for reoccupancy:

- In residential buildings: € 0.00 (free)

3. Arenales del Sol

Required documents:

- Declaration of liability

- Power of Attorney

- NIE of the trustee

- Owner’s NIE + passport

- Deed of sale or updated extract from the real estate register (Nota Simple)

- IBI Council Tax

- Technical certificate issued by an architect, with a plan indicating the dimensions of the room

- Council tax payment

- Architect's Declaration of Responsibility

- If available, license to the previous owner

Council tax amount for reoccupancy:

- In residential buildings: € 33.00

4. Benidorm

Required documents:

- Declaration of liability

- Power of Attorney

- Owner’s NIE + passport

- Deed of sale or updated extract from the Nota Simple real estate register

- IBI Council Tax

- Technical certificate issued by the architect

- NIE or authorized person's passport

- Invoices for water and electricity

- Council tax payment

- Extract from the cadastre

- If available, license to the previous owner

Council tax amount for reoccupancy:

- In residential areas: € 75.00

5. Calpe

Required documents:

- Declaration of liability

- Power of Attorney

- Owner’s NIE + passport

- Deeds or an actual Nota Simple (property registry)

- IBI Council Tax

- Technical certificate signed by the architect

- NIE or authorized person's passport

- Invoices for electricity and water

- Council tax payment

- if available, license to the previous owner

- Energy Performance Certificate

Council tax amount for reoccupancy:

- In residential areas: € waiting for information

6. Ciudad Quesada

Required documents:

- Declaration of liability

- Power of Attorney

- NIE of authorized person + passport

- Owner’s NIE + passport

- Deed of sale or updated extract from the real estate register (Nota Simple)

- IBI Council Tax

- Technical certificate signed by the architect, with a plan indicating the dimensions of the room

- Council tax payment

- Architect's Declaration of Responsibility

Council tax amount for reoccupancy:

- In residential areas: € 50.00

7. Dénia

Required documents:

- Declaration of liability

- Power of Attorney

- NIE of authorized person + passport

- Owner’s NIE + passport

- Deed of sale or updated extract from the real estate register (Nota Simple)

- IBI Council Tax

- Technical certificate signed by the architect, with a plan indicating the dimensions of the room

- Council tax payment

- Architect's Declaration of Responsibility

- Copy of the Construction Book in digital format (only for buildings that received a building license after 06/23/2011)

Council tax amount for reoccupancy:

- For residential premises: € 200.00

8. El Altet

Required documents:

- Declaration of liability

- Power of Attorney

- NIE of authorized person + passport

- Owner’s NIE + passport

- Deed of sale or updated extract from the real estate register (Nota Simple)

- IBI Council Tax

- Technical certificate signed by the architect, with a plan indicating the dimensions of the room

- Council tax payment

- Architect's Declaration of Responsibility

- If available, license to the previous owner

Council tax amount for reoccupancy:

- In residential areas: € 33.00

9. Elche

Required documents:

- Declaration of liability

- Power of Attorney

- NIE of authorized person + passport

- Owner’s NIE + passport

- Deed of sale or updated extract from the real estate register (Nota Simple)

- IBI Council Tax

- Technical certificate signed by the architect, with a plan indicating the dimensions of the room

- Council tax payment

- Architect's Declaration of Responsibility

- If available, license to the previous owner

Council tax amount for reoccupancy:

- In residential areas: € 33.00

10. Guardamar del Segura

Required documents:

- Declaration of liability

- Power of Attorney

- NIE of authorized person + passport

- Owner’s NIE + passport

- Deed of sale or updated extract from the real estate register (Nota Simple)

- IBI Council Tax

- Technical certificate signed by the architect

- Council tax payment

- Invoices for water and electricity

- If available, license to the previous owner

Council tax amount for reoccupancy:

- In residential areas: approximately € 40.00 (depending on the area of housing)

11. Javea

12. La Marina

Required documents:

- Declaration of liability

- Power of Attorney

- NIE of authorized person + passport

- Owner’s NIE + passport

- Deed of sale or updated extract from the real estate register (Nota Simple)

- IBI Council Tax

- Invoices for water and electricity

- Technical certificate signed by the architect, with a plan indicating the dimensions of the room

- Council tax payment

Council tax amount for reoccupancy:

- In residential areas: € 50.00 (for living area up to 120 m2)

13. Los Alcazares

14. Orihuela Costa

Required documents:

- Declaration of liability

- Power of Attorney

- NIE of authorized person + passport

- Owner’s NIE + passport

- Deed of sale or updated extract from the real estate register (Nota Simple)

- IBI Council Tax

- Technical certificate signed by architect with plan

Council tax amount for reoccupancy:

- In residential areas: € 110.00

15. Pilar de la Horadada

Required documents:

- Declaration of liability

- Power of Attorney

- NIE of authorized person + passport

- Owner’s NIE + passport

- Deed of sale or updated extract from the real estate register (Nota Simple)

- IBI Council Tax

- Technical certificate signed by the architect, with a plan indicating the dimensions of the room

- Council tax payment

- Construction book (for buildings built after February 1, 2007

- Registration of a building energy efficiency certificate (for buildings with a building license starting from November 1, 2007)

Council tax amount for reoccupancy:

- NIE of authorized person + passport

- Owner’s NIE + passport

- Deed of sale or updated extract from the real estate register (Nota Simple)

- Technical certificate signed by the architect, with a plan indicating the dimensions of the room

- Council tax payment

Council tax amount for reoccupancy:

- In residential areas: € 50.00

21. Torrevieja

Required documents:

- Declaration of liability

- Power of Attorney

- NIE of authorized person + passport

- Owner’s NIE + passport

- Deed of sale or updated extract from the real estate register (Nota Simple)

- Technical certificate signed by the architect

- Council tax payment

Council tax amount for reoccupancy:

- In residential areas: € 17.50

Source: torrevieja.es

Download the official information

Conclusion: Investing in the city

At Arcostec Group we invite you to invest in the city of Torrevieja, create your own local business: bar, office, real estate agency, construction of a new enterprise, industrial plant , some villas, etc... As you can see, the city council has a strong commitment to local businesses. Therefore, you have the opportunity to start your own local business and Arcostec Group will help you through the entire process, managing everything that depends on us and more. We will always fulfill the agreed obligations with the client.

![]()

CONTACT THE PROFESSIONALS AND ASK US FOR A CONSULTATION

For more information about us, please view our Portfolio.

Other articles